Olive cultivation in Greece dates back more than 4,000 years. Discoveries at archaeological sites such as Knossos, Festos, Malia, Mycenae, Pylos and Thebes bear witness to the role played by olives and olive oil in the life and customs of ancient Greece.

It was the Phoenicians who brought the olive tree to the Greek islands in the 16th century BC, from where it spread widely to the Greek mainland. The growth of olive cultivation and the use of olive oil in the western Mediterranean is attributed in part to the same Greeks who spread the olive to Italy.

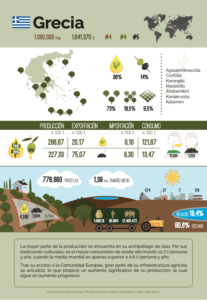

In terms of olive grove area, Greece ranks fourth among the other olive-growing countries. It has 1,080,000 hectares planted with olive groves, which represents 9.38% of the world olive grove area and 17.22% if we relate it to the total European olive grove area.

Of the area planted with olive groves, 73% is traditional. Modern high density plantations account for 18.5% of the area and modern super high density olive groves have increased their presence in Greece, currently accounting for 8.5% of the total area planted.

As for the artificially assisted irrigation of the land, it amounts to just 19.40% of the area, with 80.60% of the planted area in rainfed regime.

The main olive varieties for olive oil production are Koroneiki, which accounts for 50-60% of the country’s olive groves, Mastoidis and Adramiti.

Regarding the location of olive plantations, they are located in 50 of the 54 municipalities of the country but almost 85% of the production is concentrated in three main regions: Peloponnese (42%), Crete(31%) and in the Ionian Islands (12%). The main olive-growing areas in these places are Messinia and Ilia (Peloponnese), Iraklion and Chania (Crete) and Corfu (Ionian Islands).

There are 778,660 olive grove plots characterised by their small size, with an average size of 1.39 hectares/plot. This leads to an excessive fragmentation of the production sector, which hinders the mechanization of the crop and the transformation to efficient plantations. Excessive parceling, among other factors, leads to very low economic profitability, affected by price fluctuations at source.

Greece, which is the third largest olive-growing country, has an average harvest of 1.64 million tonnes of olives. Of the total, 86% is destined for olive oil production and 14% for table olives.

The average productivity of the plantations is 0.289 tonnes/hectare and 1.5 tonnes/hectare of table olives. This amount, although very high, is still 50% lower than the productivity achieved by Spain, which is first in this ranking.

287 thousand tons of olive oil are obtained, with an average yield of 19%. It is the number one producer of extra virgin olive oil in the world, since 75% of the olive oil produced is virgin and extra virgin and 25% lampante virgin olive oil. Greek olive oil stands out for its excellent quality.

The Greek industry has two fundamental pillars that sustain it: olive oil and table olives.

Specifically, Greece has 574 olive mills, 27 pomace extractors, 7 refineries and 176 vatting machines.

The number of oil mills has experienced an important reduction in quantitative terms, in 2012 there were 2,200 active oil mills compared to the 574 existing at present.

This reduction is motivated by the search for efficiency, facilitating the establishment of standards for quality control and the reduction of production costs through the implementation of economies of scale. To this end, important efforts are being made to concentrate the first links in the olive oil value chain, which is currently characterised by excessive fragmentation.

A significant part of the olive oil produced in Greece comes from olive presses belonging to small family businesses. Although the predominant system is the three-phase continuous extraction system and, to a lesser extent, the two-phase system.

The olive sector generates a turnover of 1,089,000,000 billion euros and employs almost 94,000 people, with 21.4 million salaries dedicated to olive growing and related industries.

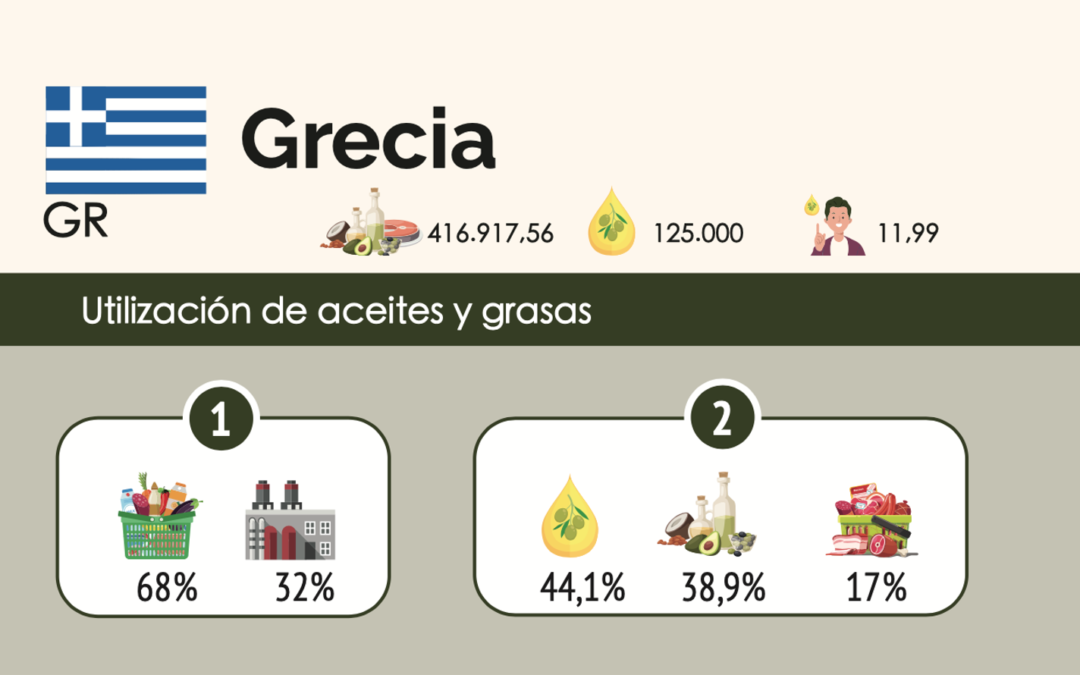

Domestic consumption reaches 125,000 thousand tons. It is the largest per capita consumer in the world, reaching 11.99 liters per person per year and accounts for 5% of food expenditure. The Greek consumer is demanding, buys high quality olive oil and values the organoleptic profile of olive oil to be stable from one season to another.

Greece exports an average of 20,000 tonnes of olive oil, and is mainly destined for countries in the European Union, particularly Italy, which buys three quarters of the olive oil exported. The rest is sold in the domestic market.

In terms of consumption, Greece stands out as the country with the highest per capita consumption in the world, with an olive oil consumption of 11.99 liters per person per year. It far exceeds the world average, which stands at 0.45 liters per person per year.

Of the total animal and vegetable fats consumed in the country, 44% is olive oil, 17% is animal fats and the remaining 39% is vegetable fats. Regarding the world, 3.93% of the olive oil consumed internationally is consumed by Greeks.

Slightly more than two thirds of the olive oil consumed is destined for human consumption and the remaining third for industrial use.

The profile of the Greek consumer is male in greater proportion than female (50.7% compared to 49.3%), over 50 years old (70%). 41% of the consumption is made by families with children. 52% of the majority of olive oil buyers have a medium income level, followed by high-income consumers (25%) and low-income consumers who account for 23%.

If we refer to the level of education, the highest consumption is seen in people with medium-high education, secondary education (35%) and university education (38%). That is to say, slightly more than 7 out of 10 liters of olive oil is consumed by people with secondary and university studies.

The tradition and culture in the consumption of Greek olive oil also translates into the search for high quality consumption of the product, so the vast majority of the oil consumed is Extra Virgin. 60% of the olive oil consumed in Greece is Virgin Olive Oil (12%) and Extra Virgin (48%). The rest of the production, 40% corresponds to the category Olive Oil (39%) and Olive Pomace Oil (1%).

The format preferred by Greek buyers is the glass container, which is in line with the demand for extra virgin olive oil, which is generally presented in glass containers. Canned packaging is also in high demand, accounting for 30%, and the PET format accounts for 20%.

According to the main use of the olive oil purchased, 40% is destined for raw consumption, 30% for cooking and 30% for frying and grilling.

Most of the olive oil is consumed at home (60%) and the rest (40%) outside the home.

Of this 40% of consumption outside the home, 25% is consumed in bars and restaurants and another 25% in the hotel and catering industry, 20% is consumed in the education sector, 20% in processing industries and 15% is consumed in hotels.

Almost 60% is purchased in supermarkets (37%) and hypermarkets (22%), 30% is purchased in oil mills, packers or other outlets, 9% is purchased online and the remaining 2% is purchased in traditional stores.